How to Analyze Rental Property Cash Flow (Without Spreadsheets)

One of the biggest fears new real estate investors have is buying a property that looks good on paper but turns into a monthly money drain. You've probably heard horror stories: "I thought it would cash flow $300/month, but I'm losing $200 every month!"

The good news? You can avoid this nightmare with proper cash flow analysis. And no, you don't need to be a spreadsheet wizard.

What is Cash Flow Analysis?

Cash flow analysis answers one simple question: After all expenses, will this property put money in your pocket or take money out?

Here's the basic formula:

Monthly Rental Income - Monthly Expenses = Cash Flow

If the number is positive, you make money. If it's negative, you lose money. Simple, right?

The 4 Key Numbers You Must Know

1. Gross Rental Income

This is what tenants pay you each month. Don't just guess—research actual rents for similar properties in the area using:

- Zillow

- Rentometer

- Local property management companies

- Recent rental listings

Pro tip: Be conservative. If similar properties rent for $1,800-2,200, use $1,800 in your analysis.

2. Operating Expenses

This is where most new investors mess up. They forget about expenses that aren't the mortgage payment:

Fixed expenses:

- Property taxes

- Insurance

- HOA fees (if applicable)

Variable expenses:

- Property management (8-12% of rent if you hire out)

- Maintenance and repairs (budget 5-10% of rent)

- Vacancy allowance (5-8% for decent areas)

- Capital expenditures (roof, HVAC, flooring - budget 5% of rent)

3. Debt Service (Mortgage Payment)

This includes:

- Principal and interest

- Mortgage insurance (if applicable)

- Any other loan payments

4. The Final Number

Gross rent minus ALL expenses = your monthly cash flow.

Real Example: $350,000 Property

Let's walk through a real example:

Property: $350,000 duplex Down payment: $70,000 (20%) Loan amount: $280,000 at 7% for 30 years

Income:

- Unit A: $1,400/month

- Unit B: $1,400/month

- Total gross rent: $2,800/month

Expenses:

- Mortgage payment: $1,862/month

- Property taxes: $350/month

- Insurance: $125/month

- Maintenance (5%): $140/month

- Vacancy (5%): $140/month

- CapEx (5%): $140/month

- Total expenses: $2,757/month

Cash flow: $2,800 - $2,757 = $43/month

Is $43/Month Good?

That depends on your goals, but here's how to think about it:

Cash-on-cash return: $43 × 12 months = $516 annual cash flow $516 ÷ $70,000 down payment = 0.74% return

That's pretty weak. You'd make more in a savings account.

Better scenarios:

- 5-8% cash-on-cash return = good

- 10%+ = excellent

- Break-even (0%) might be okay if you believe in strong appreciation

Common Mistakes That Kill Cash Flow

1. Using "Gross Rent Multiplier" Rules

You've probably heard "the 1% rule" (monthly rent should be 1% of purchase price). These rules are outdated and ignore local market conditions.

2. Forgetting About Vacancy

Even great properties sit empty sometimes. Budget for it.

3. Underestimating Maintenance

Toilets break. AC units die. Tenants move out and leave damage. Budget realistically.

4. Ignoring Property Management

Even if you plan to self-manage, factor in management costs. You might change your mind later.

The Fastest Way to Analyze Properties

Here's the truth: doing this analysis manually for every property takes forever. You'll look at 100 properties before you buy one.

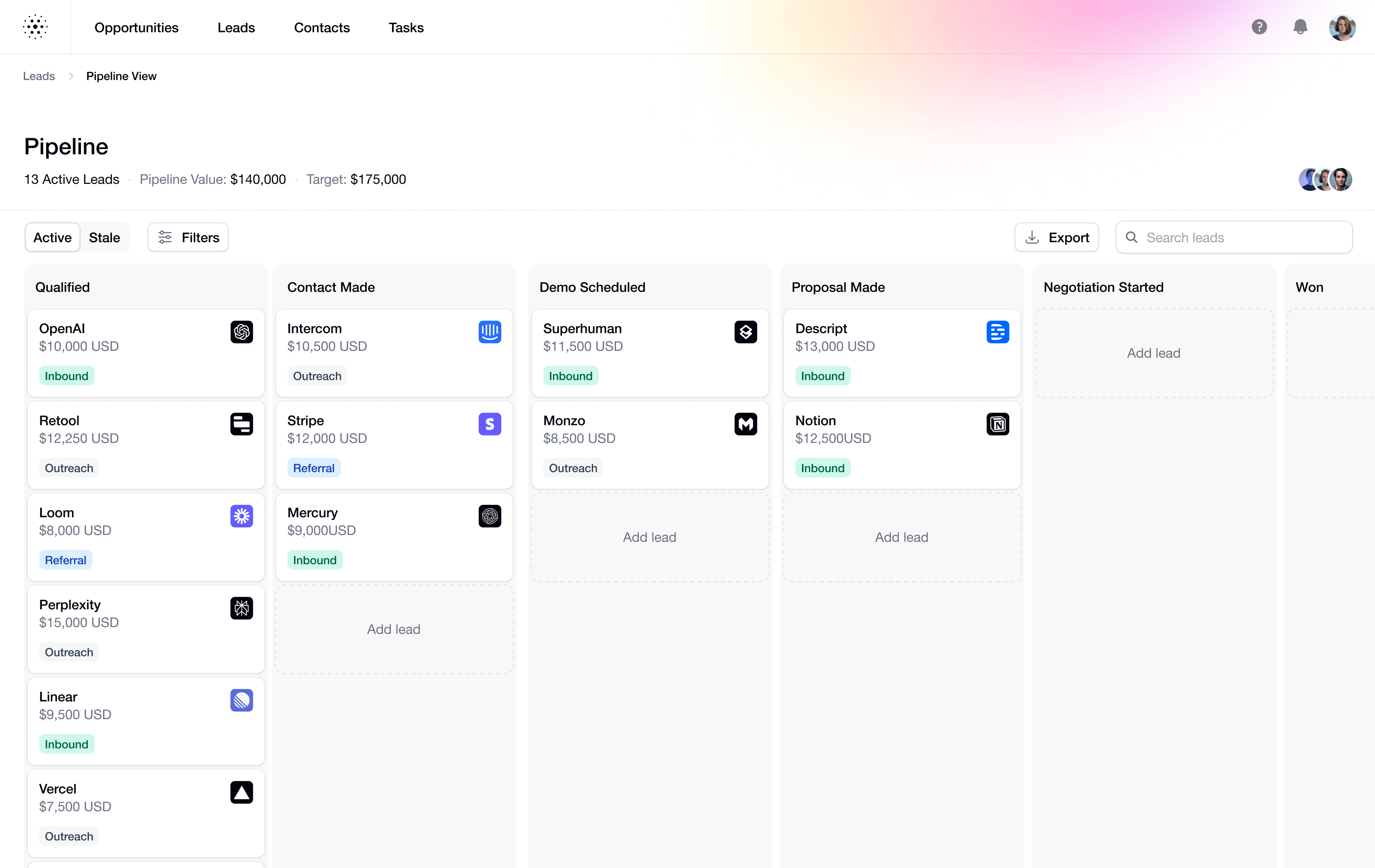

That's exactly why we built Does It Cashflow. You find a property on any MLS site, click our Chrome extension, and get instant cash flow analysis with:

- Automatic rent estimates

- Pre-filled property details

- Conservative expense calculations

- Multiple financing scenarios

No spreadsheets. No guesswork. Just the numbers you need to invest with confidence.

Start Your Analysis Today

Ready to analyze your first (or next) rental property? The key is getting started and running the numbers on real properties, even if you're not ready to buy yet.

Remember: every successful real estate investor started with analyzing their first deal. The difference between dreamers and doers? Doers run the numbers.

Want to analyze properties in seconds instead of hours? Try Does It Cashflow free and see how quickly you can evaluate rental properties directly from MLS listings.